Last call! I am getting ready to launch a premium version of Full Throttle and I would like your input. Please take a few moments to fill out this survey. Please share this newsletter with friends. If you haven't already, please subscribe.

Tesla’s CEO Elon Musk must be able to feel it. The legacy carmakers and other startups are breathing down his neck, coming after his company’s position as the number one electric vehicle (EV) manufacturer. He’s built three new factories in the past couple of years. Right now two of them are bleeding money.

While Musk has said he’s learned really hard lessons about manufacturing, he is now facing problems that he can’t totally control. As he recently told a Tesla Owners group, an automobile company is a firm that, “is desperately trying to go bankrupt at any given point.”

Telsa CEO Elon Musk tells the Tesla Owners Silicon Valley that he believes auto companies are, "always trying to go bankrupt." (Credit: Telsa Owners Silicon Valley)

Musk is talking about juggling suppliers, an assembly line, and customer expectations. Right now it’s the supply chain that plagues Musk. Those supply chains provide parts, components, and materials like aluminum to build structures. Those supply chains have been hit by a worldwide pandemic and a war of Russia’s choice in Ukraine.

Missing parts means Musk’s factories (California, Texas, Shanghai, and Berlin) can be slowed dramatically. “Factories have to be active. Otherwise, you have parts piling up in warehouses around the world,” he told the owners group, adding, “If you are missing any parts, you can't finish the car and ship it.”

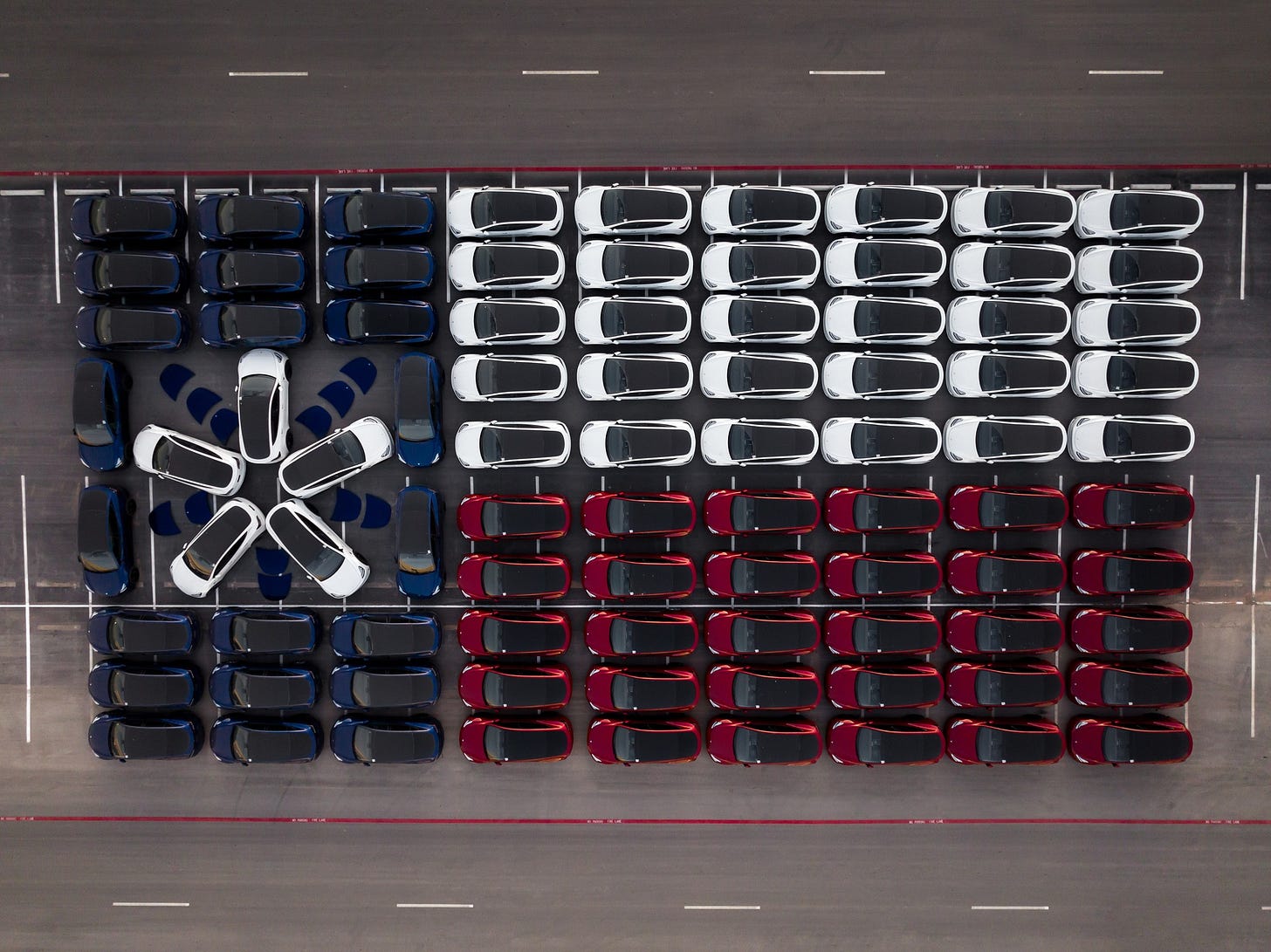

Tesla cars parked to form a version of the Texas state flag. The display was part of the company's "Rodeo" at its newly opened Austin factory. (Credit: Telsa)

How bad is it for Tesla? Musk says the Austin, Texas factory is losing, “an insane amount of money.” Musk was heated in his explanation. “Both the Berlin and Austin factories are gigantic money furnaces right now. There should be, like, a giant roaring sound, which is the sound of money on fire.”

Musk says those two factories are losing billions of dollars. “There is a ton of expense and hardly any output,” he told the four members of the Tesla Owners of Silicon Valley on June 2nd. The CEO thinks this difficult journey isn’t over. “The past two years have been an absolute nightmare of supply chain interruptions, one thing after another, and we’re not out of it yet,” he said.

Musk says his new factories in Austin and Berlin are, "burning cash." (Credit: Telsa Owners Silicon Valley)

Let’s take a macro look at when Musk, and the rest of us, may see relief from these troubles of the supply chain and the inflation associated with that problem.

Not surprisingly, a lot of the inflation we are suffering follows a path directly back to the pandemic and Ukraine. A San Francisco Federal Reserve official published a letter saying, “Continued labor shortages and global supply disruptions related to the pandemic and the war in Ukraine,” account for a majority of inflation in this cycle. The Fed official argues only a third of inflation is due to increased demand. The other two thirds of inflation are caused by problems on the supply side.

Gas prices in November 2021 in Alexandria, Virginia. (Credit: Andrew Caballero-Reynolds/AFP via Getty Images)

The White House in an April paper on the economy says that supply chains remain, “fragile.” “Private firms are beginning to increase their resilience through visibility, redundancy, and agility,” the report states.

There are indications that supply chains are starting to heal. But it won’t be quick. This is why several American industries are trying to realign their supply chains and are calling on the government to help.

Two weeks ago, major carmakers sent a letter to Congressional leaders asking that they pass a bill to provide $52 billion in subsidies to the US semiconductor industry. The companies say, “the auto industry is facing substantial production losses stemming from capacity challenges across the global semiconductor supply chain. Numerous automakers have been forced to halt production.”

Signatories to letter calling for a $52 billion investment in US semiconductor production. (Credit: Alliance for Automotive Innovation)

You may have been surprised by our inflation and these supply chain constraints. But they were predicted early in the pandemic by some experts. In the first month of the pandemic, Professor David Kimchi-Levi of MIT explained that supply chains would falter as demand waned. “You can see there are cascading effects that have an impact,” he said.

So what is next? Musk, while saying we are not out of the supply chain problem yet, predicts his money furnace factories, “will all get fixed real fast.” We will see.

(Cover photo credit: Tesla)