September 29, 2021

The shortage of the tiny building blocks known as semiconductors has brought much of the automobile industry to its knees. The lack of chips forced the shutdown of vehicle assembly lines leading to fewer new cars on dealers' lots.

RESTARTING THE LINE

That is changing this week. General Motors resumed production of full-size SUV and truck production in Missouri on Monday. Next week, a plant in Lansing, Michigan will also restart the line. GM believes the worst of the chip shortage is slowly coming to an end, telling me in a statement, “we remain confident in our team’s ability to continue finding creative solutions to minimize the impact on our highest-demand and capacity constrained vehicles.”

GM plant in Wentzville, Missouri which restarted production this week despite the continuing chip shortage. (Credit: GM)

Ford tells me it is still working to deal with the “global semiconductor shortage” by, “prioritizing key vehicle lines for production while completing vehicles built without certain parts.”

Tesla says its work around included re-writing some of its vehicles' computer code, “in response to ongoing semiconductor shortages.” The company’s CEO Elon Musk told a tech forum he believes the shortage is waning and should be “short-term,” as more chip manufacturing plants and lines are built.

Elon Musk of Tesla believes the chip shortage will be "short lived."(Credit: Italian Tech Week)

HOW DID WE GET HERE?

The chip industry believes the car makers put themselves in this position by cancelling orders as the pandemic became serious last year. GM’s CEO Mary Barra admitted as much in a conversation with Delta Airlines CEO Ed Bastian. “Forecasts were low at the beginning of the year, but then, you know, just the usage of semiconductors has, has really increased,” she said.

GM CEO Mary Barra with Delta CEO Ed Bastian on the airlines' "Gaining Altitude" series. (Credit: Delta)

The Chief of Staff of SEMI, the association representing chip-makers, says its members were stuck holding the bag. But Bettina Weiss suggests the future will be different. She says chip-makers, “were caught in a very, very bad place, right, because they were sitting on an inventory at first that the automakers didn't take. So there are a lot of conversations going on right now. It's to infuse an element of collaboration, visibility and synchronization as automakers plan what they need.”

NEW RELATIONSHIPS

That collaboration may be direct relationships. GM, which has purchased chips from suppliers, will now go directly to the chip makers. Barra said, “we're building direct relationships with the manufacturer so it's a solvable problem but it's going to be here a little longer.”

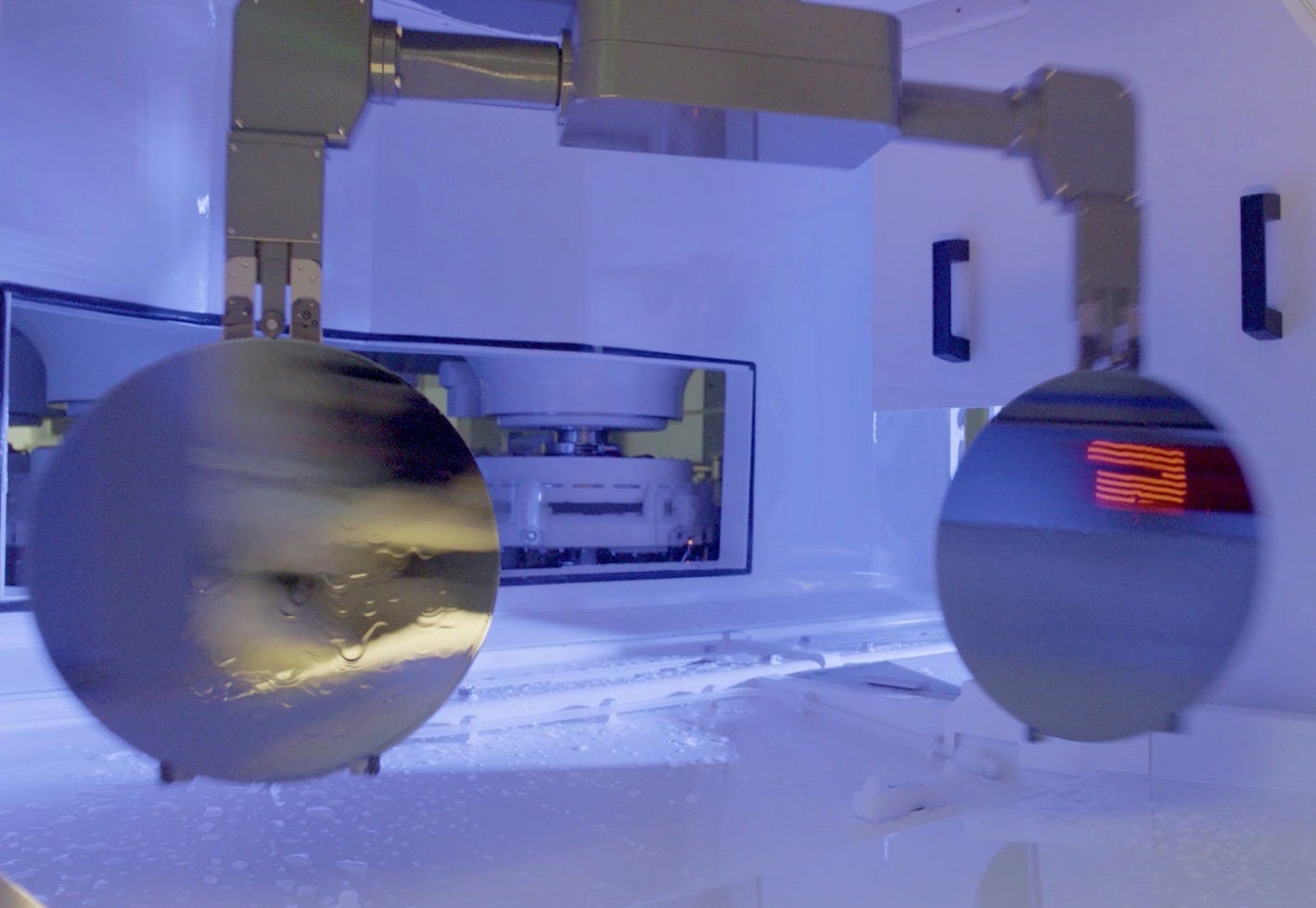

Inside an Intel semiconductor production facility. (Credit: Intel)

Demand for these small chips is only expected to grow. As vehicles move to electrification and autonomy, more chips are needed. “A full size truck or utility, it tends to have as much as 30% more chips in that vehicle than say a small crossover, and so is customer needs are shifting, we need more and more semiconductors,” Barra explained.

ADJUST THE SUPPLY CHAIN?

While this chip shortage has been painful, it has highlighted growing problems we will all hear more about in the coming years. I am referring to supply chains and US-based manufacturing. At one point, SEMI tells me, the US share of chip production worldwide was 50%. That number is now about 12%.

Production of Intel semiconductors in New Mexico. (Credit: Intel)

The current and past US administrations have worked to incentivize growth of American manufacturing. But, on supply chains, the Biden Administration made some little-noticed news a couple of weeks ago. It relaunched what is called “High Level Economic Dialogue” (HLED) with Mexico, a type of discussions that were eliminated by the previous administration.

MEXICO- HLED

It appears the US government is trying to prepare, promote, and expand a supply chain to our south for the long-term future. A Senior Administration Official told reporters, “it's really focusing on issues of resilience, of minimizing supply chain disruptions, of looking at leveraging strategic opportunities with Mexico.”

This restart of HLED may not be directly tied to the chip shortage, nor does it suggest chip plants will be popping up south of the border. But the auto industry is key for the President and Vice President and, “what their priorities are for the United States, in terms of preparing the United States for future competitiveness, retooling the automotive industry to be able to compete in the electric vehicle industry,” the unnamed official said.

This chip shortage resulted in a couple of years of pain for the automakers and consumers (Goldman Sachs reversed course and now thinks the shortage will last into next year). But, it does appear automakers and the US government have learned a lesson.