You have found Full Throttle! This newsletter is about to mark one year of publishing. I plan a "Premium" version and would like your help. Can you take a few moments and fill out this survey? Thanks!

American, Asian, and European automakers are scrambling to ramp up production of electric vehicles (EVs). Those companies are racing to catch up to China. A new report says China is home to nearly half of all the electric vehicles in the world and is a “powerhouse” in EV manufacturing.

The report, titled “Red Ink” (who says researchers don’t have a sense of humor), was released by the Center for Strategic and International Studies (CSIS). It is one of the few attempts we have seen aimed at quantifying how much China is spending to build its industries compared to other major economies. The findings are striking and explain why the Chinese are dominating some industries.

The assembly line of China's EV company BYD. (Credit: BYD)

Just about every industrial nation spends some money to help key industries. I’ve written here about the Biden Administration’s effort to help fund the battery supply chain, extraction and refinement of battery minerals, and infrastructure dollars for charging stations and EV adoption.

CHINA IS AN OUTLIER

What the CSIS study shows is that by just about any measure, US industrial investment (and other major economies) is dwarfed by China’s spending. The researchers admit it is difficult to get some hard data from China, and they left out government procurement of products. Therefore, the authors of the report consider their estimates conservative.

In 2021 Chinese EV maker BYD celebrated the production of its one millionth vehicle. (Credit: BYD)

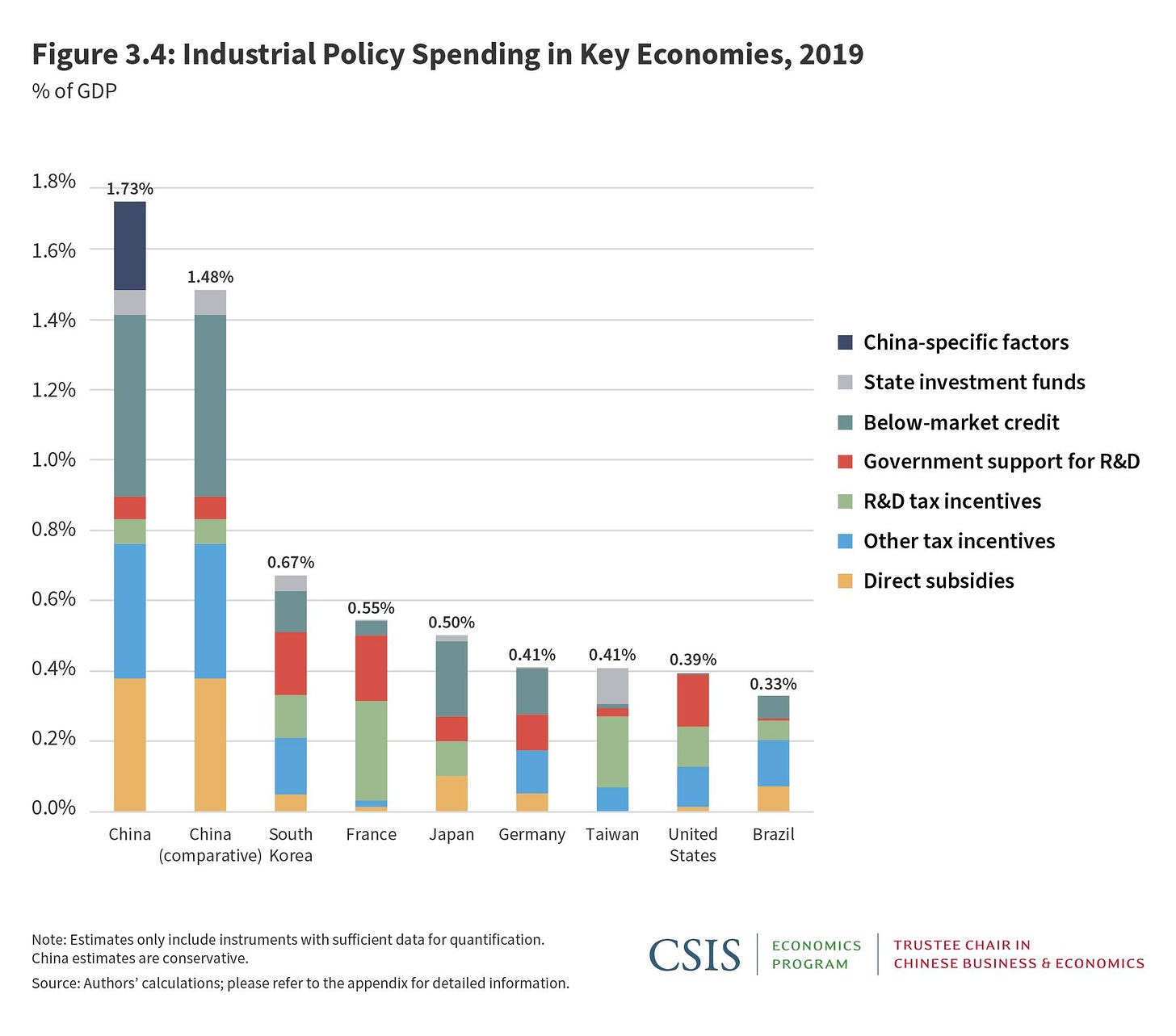

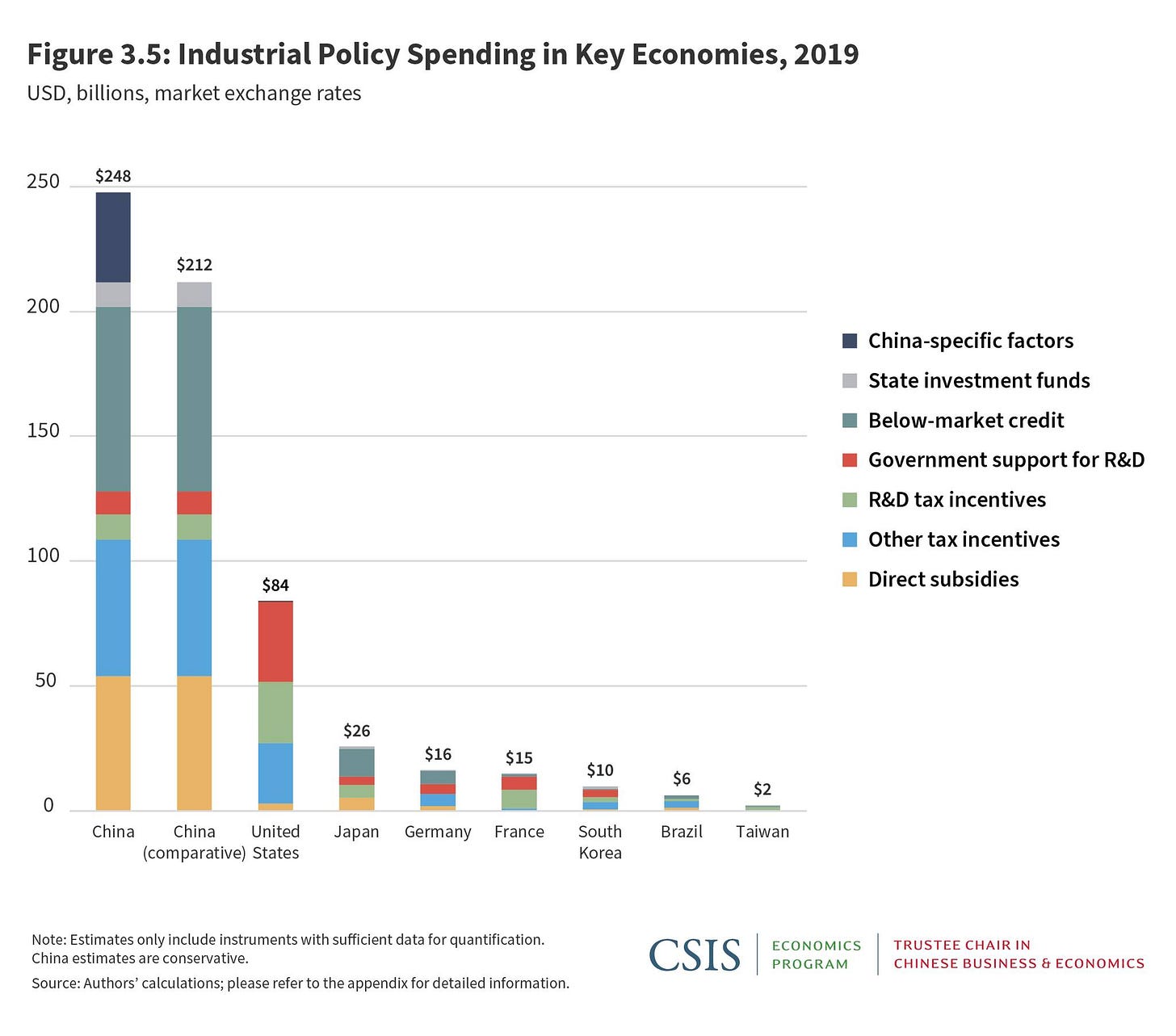

The bottom line; China is spending four times what the US appropriates for industrial investment. The Chinese are spending nearly 2% of their gross domestic product to help their homegrown companies. That is $248 billion and is more than China spends on defense. Scott Kennedy, one of the report’s authors says, "China spends a massive amount on industrial policy and is a global outlier."

The chart below lays out the actual numbers in the CSIS report. China’s spending about 1.73% of GDP while the US is a little more than one-third of a percent of GDP to help industry.

The researchers break down the Chinese spending by category. There are plenty of direct dollars going to companies and state-owned industries. Where China differs significantly from the US is cheap loans. China’s largest industrial investment is below market credit for businesses.

CHINA'S EV SECTOR

One of China’s strategic sectors in its industrial-economic framework known as China 2025 is called New Energy Vehicles. China has made EVs a priority for the past decade. As the CSIS researchers say, “Explicit political support combined with high subsidies has brought a surge in investment… A high-end estimate for overall government support to the EV industry between 2009 and 2017 totals over 390 billion RMB ($58 billion),” in China, the report says. That number may have increased to 1 trillion RMB since then, according to CSIS.

Most of the Chinese EV production is the domestic market. Soon the Chinese will start exporting to Europe. But its unlikely you will drive a Chinese EV anytime soon.

A BIG TAKEAWAY

The communist government has used its investments to try and push innovation in EV development. “What makes China’s approach notable is that its EV promotion policy was linked explicitly to a strategy of industrial expansion and technological leapfrogging. After 2016, subsidies were increasingly tied to the deployment of more advanced technologies, for example, higher density batteries that allowed for longer ranges,” the report says.

CSIS's Ilaria Mozzocco highlights the study's main conclusions. (Credit: CSIS)

Kennedy explains that leapfrogging is China’s attempt to rid itself of western suppliers for parts used in internal combustion engine vehicles. They want to make an all-Chinese EV.

Innovation is one of the key take-aways from this report. The researchers say China’s policies, “targeted industries at the frontier of innovation, whereas previous projects have been mostly about catching up.”

Employees work on the assembly line of Wuling Hongguang Mini EV microcar in Liuzhou, China in 2021. (Credit: Li Hanchi/VCG via Getty Images)

The CSIS team looked at three of China’s industries; EVs, aluminum, and semiconductors. These are three of the big building blocks for the transportation transformation.

China is a member of the World Trade Organization that tries to enforce a level playing field for global industry. The researchers don’t answer the question of whether China is playing fair by funding its industries at levels that far surpass its competitors.

(Cover image credit: BYD)